2021-01-22 2021年金價預測,趨勢和5年預測

2021 Gold Price Prediction, Trends, and 5-Year Forecast2021年金價預測,趨勢和5年預測

By Jeff Clark, Senior Analyst, HardAssetsAlliance

Most price forecasts aren’t worth more than an umbrella in a hurricane. There are so many factors, so many ever-changing variables, that even the experts usually miss the mark.

大多數價格預測的價值都不過是颶風的保護傘。有太多的因素和如此多千變萬化的變量,甚至連專家們也常常錯過這個指標。

Further, some forecasters base their predictions on one issue. “Interest rates will rise so gold will fall.” That’s not even an accurate statement, let alone a sensible prediction (it’s the real rate that affects gold prices, as I’ll show below).

此外,一些預報員的預測基於一個問題。 “利率將上升,因此黃金將下降。”這甚至不是一個準確的陳述,更不用說是明智的預測了(影響黃金價格的其實是真實利率,如下所示)。

But there is value in considering predictions. It can solidify why one has invested, offer factors that may have been overlooked, or even cause one to revise their expectations.

但是考慮預測是有價值的。它可以鞏固人們為什麼進行投資,提供可能被忽視的因素,甚至導致人們修改其期望的理由。

So while we take predictions with a grain of salt, let’s look at what might be ahead for the gold price in 2021 and the next 5 years. We’ll first summarize what many analysts are predicting, and then look at the factors that are likely to have the biggest impact on gold. I’ll conclude with the probable prices I see based on those factors, as well as some long-term projections.

因此,儘管我們帶著保留態度來進行預測,但讓我們看一下2021年及未來5年金價的未來走勢。我們將首先總結許多分析師的預測,然後研究可能對黃金產生最大影響的因素。我將根據這些因素得出的可能的價格以及一些長期預測作為結論。

This will be fun, so let’s jump in!

這將會很有趣,我們開始吧!

The Golden Crystal Ball

金色手晶球

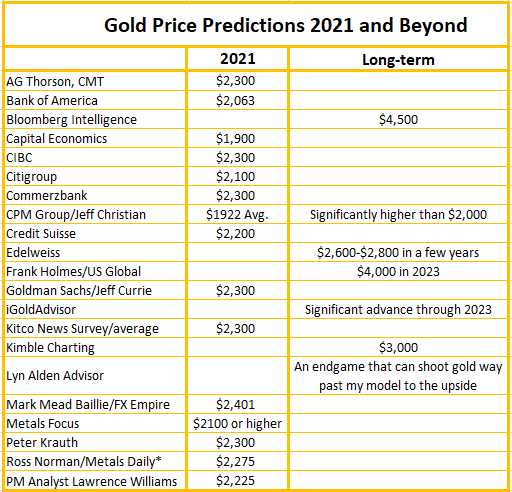

I’ve compiled gold price predictions from a number of banks and precious metals analysts.

我已經彙編了許多銀行和貴金屬分析師的金價預測。

The table below shows the gold price prediction from various consultancies and independent analysts. Not all gave a forecast for both time periods, but I’ve listed what they’ve stated publicly. Here’s what they think is ahead for gold.

下表顯示了來自各種諮詢公司和獨立分析師的金價預測。並非所有人都對這兩個時間段都做出了預測,但我已經列出了他們公開聲明的內容。他們認為這是黃金的未來。

You can see that most analysts predict gold will exceed $2,000 per ounce in 2021. Two project it will average in the $1,900-range. And of those I found, all are very bullish long-term (though this survey is not exhaustive, as there are always analysts who are bearish).

您可以看到,大多數分析師預測黃金在2021年將超過每盎司2,000美元。兩個項目的平均價格將在1,900美元左右。在我發現的中,長期來看都是樂觀的(儘管這項調查並不詳盡,因為總是有分析師看空)。

A couple interesting points to highlight from these analysts…

這些分析師指出了幾個有趣的觀點……

CPM Group’s projection is lower than most, but if gold averages $1,922 in 2021, it would represent an 8.2% increase over 2020 and a record annual average. They also state that “we expect prices to rise sharply at some point in the future, to new records significantly higher than $2,000. Such an increase would be expected to be caused by investors buying increased volumes of gold in a future economic and political crisis… the period 2023 – 2025 is perhaps the most likely time period to expect such.” (Their outlook and projections can be viewed in more detail in their monthly Precious Metals Advisory on their website.)

CPM Group的預測低於大多數人,但如果2021年黃金平均價格為1,922美元,則將比2020年增長8.2%,創下年度均值新高。他們還說:“我們預計價格在未來某個時候會急劇上漲,達到新的記錄,大大高於2,000美元。預計這種增加是由於投資者在未來的經濟和政治危機中購買了更多數量的黃金……2023年至2025年也許是最可能預期這種情況的時期。” (他們的前景和預測可以在其網站上的每月貴金屬諮詢中更詳細地查看。)

Meanwhile, we’ll note that analyst Ross Norman has won first place in the LBMA gold price survey nine times. He predicts gold will rise 20% this year.

同時,我們會注意到,分析師羅斯·諾曼(Ross Norman)已九次獲得LBMA金價調查的第一名。他預計今年黃金將上漲20%。

Last, the average 2021 gold price forecasts from these analysts is $2,228.

So what is my 2021 gold price prediction? To answer that question we have to look at the various factors that are likely to have the biggest impact on the price, both positive and negative.

最後,這些分析師預測的2021年黃金平均價格為2,228美元。

那麼我對2021年金價的預測是什麼?為了回答這個問題,我們必須研究可能對價格產生最大影響的各種因素,包括正面和負面。

The Golden Path

黃金路

Based on my experience in the gold sector, here is a review of the factors I believe will have the most influence on the price this year.

根據我在黃金行業的經驗,以下是對我認為對今年價格影響最大的因素的回顧。

Monetary and Fiscal Stimulus: Monetary stimulus (from the Fed) is not expected to let up this year. As one example, Chicago Fed President Charles Evans said, “Economic agents should be prepared for… an expansion of our balance sheet…”

貨幣刺激和財政刺激:預計今年(來自美聯儲)的貨幣刺激不會減弱。例如,芝加哥聯儲主席查爾斯·埃文斯(Charles Evans)說:“應該為...擴大我們的資產負債表做好準備。”

And fiscal stimulus (from congress and the president) is likely to explode in 2021. The interesting thing about this type of stimulus is that it bypasses the banks and puts funds directly into the hands of people who will have a propensity to spend it.

財政刺激措施(來自國會和總統的刺激措施)很可能在2021年爆發。關於這種刺激措施的有趣之處在於,它繞過了銀行,直接將資金投入了有使用意願的人們手中。

President-elect Joe Biden has explicitly stated that his “first priority” when he takes office is a stimulus package. And with the return of Janet Yellen—now as Treasury Secretary—further stimulus will be supported. During her tenure as Fed Chair and in recent communications, the message is very clear: more fiscal stimulus is coming.

總統喬·拜登曾明確表示,他上任時的“首要任務”是一輪紓困計劃。隨著珍妮特·耶倫(現任美國財政部長)的回歸,將進一步刺激經濟。在她擔任美聯儲主席期間以及最近的通訊中,信息非常明確:即將出台更多的財政刺激措施。

Fiscal stimulus amounts are not finalized as we write, but based on what has been said publicly so far, we should expect something in the range of at least $3 trillion in fiscal spending in 2021.

財政刺激計劃的金額尚未最終確定,但根據迄今為止的公開講話,我們預計2021年的財政支出至少會達到3萬億美元。

Monetary and fiscal stimulus is arguably one of the strongest catalysts for gold, not to mention the ramifications that can come from it. Of course if they don’t enact stimulus, or much less than expected, it would be a drag on the gold price. But that isn’t likely to happen, at least this year.

貨幣和財政刺激可以說是最強大的黃金催化劑之一,更不用說可能產生的後果了。當然,如果他們不採取刺激措施,或者不像預期那樣刺激措施,那將拖累金價。但這至少在今年不會發生。

If stimulus efforts play out as expected, the gold price will…(rise)

如果刺激措施如預期般發揮作用,那麼金價將……上漲

Low Interest Rates: The Fed has signaled ultra-easy monetary conditions for at least the next year. Chicago Fed President Charles Evans said, “The Fed’s policy stance will have to be accommodative for quite a while… economic agents should be prepared for a period of very low interest rates.”

低利率:美聯儲至少在明年暗示了超寬鬆的貨幣條件。芝加哥聯儲主席查爾斯·埃文斯(Charles Evans)表示:“在相當長的一段時間內,美聯儲的政策立場必須是寬鬆的……經濟機構應該為低利率時期做好準備。”

The “real” rate (10-year Treasury minus the CPI) is already negative in the US. And many analysts expect the spread between the nominal interest rate and inflation to widen if the economy begins to recover. In other words, even if nominal yields stay flat, the real yield would continue to fall if inflation picks up.

在美國,“實際”匯率(10年期國債減去CPI)已經為負。許多分析師預計,如果經濟開始復蘇,名義利率和通貨膨脹率之間的差距將會擴大。換句話說,即使名義收益率保持持平,但如果通脹回升,實際收益率將繼續下降。

• The relationship between gold and real yields is one of the most consistent predictors of the gold price.

黃金與實際收益率之間的關係是金價最一致的預測指標之一

Inflation-adjusted yields are likely to remain negative. If so, the gold price will (rise)

經通貨膨脹調整後的收益率可能保持負數。如果是這樣,金價將(上漲)

U.S. Dollar: Because gold is universally priced in U.S. dollars, they are usually inversely correlated. As such, a weak U.S. dollar is supportive of higher gold prices. Ongoing stimulus efforts will keep the USD under pressure—and given the amount of fiscal expenditures expected this year, the dollar is likely to fall, which will push gold…(higher)

美元:由於黃金的價格普遍以美元計價,因此它們通常成反比。因此,美元疲軟支持金價上漲。持續的刺激措施將使美元承受壓力。鑑於今年預期的財政支出額,美元可能會下跌,這將推動黃金…上漲

If the virus is contained and the Fed and congress scale back on their stimulus efforts, the dollar would rise and gold would probably…(go down)

如果遏制了這種病毒,而美聯儲和國會縮減刺激措施的規模,美元將上漲,黃金可能…下跌

Inflation Threat: Since the Fed has expressly stated it is comfortable with inflation rates exceeding 2%, a higher CPI is a distinct possibility. Consider what else is transpiring that could lead to higher inflation rates this year…

通貨膨脹威脅:由於美聯儲已明確表示對通貨膨脹率超過2%感到滿意,因此很可能會出現更高的CPI。考慮一下正在發生的其他事情可能導致今年的通貨膨脹率上升……

Debts and deficits have reached record territory, which historical studies have shown lead to higher rates of inflation. The federal debt ended 2020 at 135.6% of GDP, a level unmatched in modern history. And the federal deficit is now $3.2 trillion, more than twice the level of the Great Recession and a level not seen in U.S. history.

債務和赤字已達到創紀錄的水平,歷史研究表明,這導致通貨膨脹率上升。到2020年,聯邦債務佔GDP的135.6%,是現代歷史上無法比擬的水平。聯邦赤字現在為3.2萬億美元,是大蕭條時期的兩倍多,是美國歷史上從未見過的水平。

Meanwhile, the last reading of the Purchasing Managers Index (PMI) in 2020 showed that while new orders dropped, input prices rose. In the case of the services PMI, input prices jumped to the highest on record for the second straight month, while input prices in the manufacturing survey hit the highest level since mid-2018.

同時,2020年採購經理人指數(PMI)的最新讀數顯示,儘管新訂單減少,但投入價格卻上漲。就服務業採購經理人指數而言,投入價格連續第二個月躍升至歷史最高水平,而製造業調查中的投入價格則創下了自2018年中以來的最高水平。

Commodity prices have also jumped. Many are up double-digits from a year ago, with lumber prices up triple digits.

大宗商品價格也上漲了。許多木材的價格比一年前上漲了兩位數,而木材價格上漲了三位數

Meanwhile, St. Louis Fed President James Bullard said his bank has gotten reports of supply constraints of various kinds that are “intense” and led to a big increase in prices. “The quiescence of inflation that has characterized the last decade may not be a good guide for what’s going to happen in 2021, where I would expect possibly higher inflation than we’re used to.”

同時,聖路易斯聯儲主席詹姆斯·布拉德(James Bullard)表示,他的銀行已經收到有關各種“緊張”供應限制的報告,導致價格大幅上漲。 “過去十年來一直沒有出現的通貨膨脹的靜止狀態可能無法很好地指導2021年的情況,我希望在那兒,通貨膨脹率可能會比過去更高。”

And Kansas City Federal Reserve President Esther George, one of the “hawks” at the central bank, said she is “worried inflation is brewing and could surprise to the upside.”

堪薩斯城聯邦儲備銀行行長埃絲特·喬治(Esther George)是中央銀行的“鷹派”之一,她說,她“擔心通貨膨脹正在醞釀之中,並可能令其上行空間感到意外。”

Last, if one subscribes to the theory that inflation can’t happen without higher wages, I’ll point out that 20 U.S. states mandated higher minimum wage rates that started in January. And four more states, plus Washington DC, will raise their minimum wages later in the year.

最後,如果有人讚成沒有高工資就不會發生通貨膨脹的理論,我會指出,美國的20個州規定從1月份開始提高最低工資標準。還有另外四個州,加上華盛頓特區,將在今年晚些時候提高最低工資。

If rising consumer prices visit us in 2021, investors are bound to look for inflation hedges, gold being an obvious choice and one that will push the price… (higher)

如果2021年消費物價上漲到訪我們,投資者勢必會尋求通脹對沖,黃金無疑是一個選擇,並且會推高價格……

Continued Covid Fallout: A new variant of COVID-19 appears to have emerged in the UK and South Africa. This could extend lockdowns and border closures. We also have to consider the possibility the current strain of the virus isn’t contained.

持續的Covid擴散:英國和南非似乎已經出現了COVID-19的新變種。這可能會延長封鎖時間和關閉邊境。我們還必須考慮不包含當前病毒株的可能性。

The vaccine is a positive step for the world, but there are still many unknowns. If fallout from the virus continues, gold will see support and…(go up)

疫苗對世界來說是積極的一步,但仍有許多未知數。如果該病毒的影響持續下去,黃金將獲得支撐並…上漲

If the vaccine proves effective and leads to a resurgence in the economy, then the gold price is likely to…(go down)

如果疫苗證明有效,並導致經濟復甦,那麼金價可能會……下跌

Prolonged Recession: Despite the U.S. stock market currently near record highs, many businesses continue to struggle, with ongoing closures still being reported. Bankruptcies are likely not over, nor is elevated unemployment levels. A double dip recession has been discussed by many pundits. Since gold usually performs well during recessions, the price would likely…go up.

長期衰退:儘管美國股市目前已接近歷史高位,但許多企業仍在苦苦掙扎,據報導仍在關閉。破產可能不會結束,失業率也不會上升。許多專家討論了雙底衰退。由於黃金通常在衰退期間表現良好,因此價格可能會…上漲

Black Swans: A black swan is an event that catches investors off guard. And 2021 is ripe for such an event—potential candidates include a messy Brexit, social unrest, or a stock market or real estate crash. Another shock to society or the markets would put a spotlight on gold’s hedging abilities, just like it did in 2020, and push the price… higher

黑天鵝:黑天鵝是使投資者措手不及的事件。到2021年,此類事件的時機已經成熟,潛在的候選人包括混亂的英國退歐,社會動盪,股市或房地產崩潰。就像2020年一樣,社會或市場遭受的又一次沖擊將使黃金的避險能力成為人們關注的焦點,並推高價格。

There are many factors that could impact the gold price, of course, in both the short and long term, but these are the ones likely to have the greatest impact this year.

當然,無論短期還是長期,都有許多因素會影響金價,但這些因素今年可能會產生最大的影響。

My 2021 Gold Price Prediction

Jeff Clark的2021金價預測

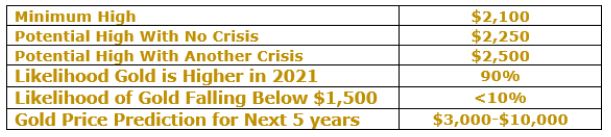

My forecast for the gold price in 2021 is based on the current environment of negative real yields, a weak dollar, rising inflation expectations, and ongoing monetary and fiscal stimulus. We also have to consider the Fed’s diminishing ability to respond effectively to crisis—their “toolbox” is indeed getting low.

我對2021年金價的預測是基於當前實際負收益率,美元疲軟,通脹預期上升以及持續的貨幣和財政刺激環境。我們還必須考慮美聯儲有效應對危機的能力正在減弱,因為它們的“工具”確實越來越少。

As a result, I expect the gold price to be higher in 2021. Here are my predictions.

因此,我預計2021年金價會上漲。這是我的預測。

The most important message from this analysis is that even if I’m wrong, there has rarely been a more important time to own gold than now. That means any dips in price should be bought, especially for those that don’t hold a meaningful amount.

該分析報告最重要的信息是,即使我錯了,擁有黃金的時間也很少比現在更重要。這意味著應該購買任何價格下跌的產品,尤其是對於那些沒有足夠價格的產品。

• Remember, gold is less about the price and more about its value, meaning what it will buy you.

請記住,黃金與價錢無關,而與價值有關,這意味著它將為你(未來賣掉時)買到什麼。

Regards,

Jeff Clark

2021/01/21

Shiny黃金白銀交易所

引用來源: HardAssetsAlliance

黃金白銀最高價回收買取 秉持專業及誠信為原則!

收購專線:台北中正店 02-2339-0222/台南永成店 06-2627588

[多種回收項目:金條/銀條、金幣/銀幣、黃金飾品、K金飾品、鉑金條塊、白金飾品、工業銀廢料、晶元科技廢料...]